In total, the amount of money people said they lost to scammers was up 70% from the year before.īy knowing how the IRS does contact taxpayers, you'll be better able to spot fraud if it comes your way. The Federal Trade Commission reported that Americans lodged nearly 6 million fraud and scam complaints in 2021. Scammers have been aggressively capitalizing on the pandemic, and not just through tax scams: Thousands of Americans have been victims of investing scams, online shopping fraud and fake online lotteries. The recent surge in text scams, which are known as "smishing" attempts," is simply the latest round of fraud - and it likely won’t be the last. Since the fall of 2020, the IRS has observed an increase in phishing scams that seek payment or personal information.

Irs scam itunes refund how to#

(Further instructions on how to do that are available here.) The IRS is warning taxpayers about a new scam involving tax refunds. If you do receive a spam text, the IRS encourages you to report it via email. In fact, the IRS says you can delete any texts that claim to be from the agency. See Identity Theft Central to learn about the signs of identity theft and actions to take.The best way to avoid becoming a victim of a phishing attempt is to not click suspicious links. Taxpayers who attempt to e-file their tax return and find it rejected because a return with their SSN already has been filed should file a Form 14039, Identity Theft Affidavit PDF, to report themselves as a possible identity theft victim. By acting quickly and following these steps you’ll be in a good. Report the number to and be sure to put IRS Phone Scam in the subject line.

An IP PIN is a six-digit number that helps prevent identity thieves from filing fraudulent tax returns in the victim's name. There are steps that you should take when it comes to reporting IRS tax scams: Report the call to TIGTA using their IRS Impersonation Scam Reporting form or by calling 80.

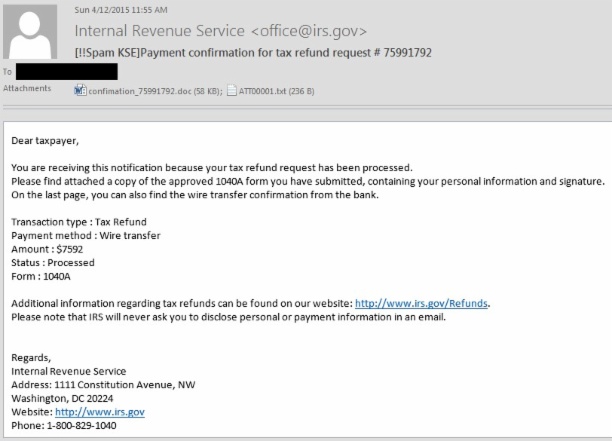

Taxpayers who believe they may have provided identity thieves with this information should consider immediately obtaining an Identity Protection PIN. For security reasons, save the email using "save as" and then send that attachment to or forward the email as an attachment to The Treasury Inspector General for Tax Administration (TIGTA) and IRS Criminal Investigation have been notified. People who receive this scam email should not click on the link in the email, but they can report it to the IRS. The phishing website requests taxpayers provide their: A new scam alert has been issued by the Internal Revenue Service where a letter informs you about a tax refund that you haven’t claimed yet. It says that you can get a third Economic Impact Payment (EIP) if you click a link that lets you access the form for your additional information and get help with the application. There’s a fake IRS email that keeps popping into people’s inboxes. The suspect emails display the IRS logo and use various subject lines such as "Tax Refund Payment" or "Recalculation of your tax refund payment." It asks people to click a link and submit a form to claim their refund. Division of Consumer and Business Education, FTC. The IRS is also receiving reports of emails urging people to 'claim your tax refund online' and. Taxpayers who believe they have a pending refund can easily check on its status at Where's My Refund? on IRS.gov. The IRS said its receiving hundreds of forwarded scam emails every day from concerned taxpayers. If you clicked a link in one of these text or emails and shared personal information, file a report at to get a customized recovery plan based on what information you shared. Forward a screenshot or the email as an attachment to. was stopped from putting 2,000 on iTunes cards, as well. Report unsolicited texts or emails claiming to be the IRS. customers avoid losing thousands of dollars on iTunes gift card scams.

The IRS' has received complaints about the impersonation scam in recent weeks from people with email addresses ending in ".edu." The phishing emails appear to target university and college students from both public and private, profit and non-profit institutions. Here are some of the latest IRS-related scams.

WASHINGTON - The Internal Revenue Service today warned of an ongoing IRS-impersonation scam that appears to primarily target educational institutions, including students and staff who have ".edu" email addresses.

0 kommentar(er)

0 kommentar(er)